3 Top News For Investing Your Finances in 2024

Wiki Article

What Is The Best Option To Invest In The Stock Market For 2024?

Diverse strategies can be employed to approach investing in the stock market through 2024. These strategies are tailored according to risk preferences and objectives. Diversified Index Funds (DIFs) and ETFs are among the most effective strategies to invest this year on the stock markets.

S&P 500 Index Funds. S&P 500 Index Funds provide wide exposure to large-cap U.S. shares, with an even balance of return and risk.

Thematic ETFs. ETFs with a concentration on the latest technologies such as clean energy, biotechnology and artificial intelligence are a fantastic opportunity to profit from the growth of sectors.

Dividend Stocks:

Dividend Stocks With High Yields - Companies which have consistently paid out regularly high dividends can be an excellent source of income in turbulent markets.

Dividend Aristocrats are companies which have continuously increased their dividends for a period of 25 years or more and have demonstrated financial stability.

Growth Stocks

Tech Giants. Companies such as Apple and Microsoft continue to show robust growth potential due to their innovation and leadership in the market.

Emerging Technology Companies: While they carry higher risks, investing in smaller, more innovative companies can provide the highest growth potential.

Stocks International:

Emerging markets: As countries such as China, India and Brazil expand, they present opportunities to expand.

Markets in developed countries Diversifying your business's operations into European markets and other developed economies can help you achieve stability and growth.

Sector-Specific Investments:

Technology: AI, cloud computing as well as cybersecurity remain at the forefront of technology.

Healthcare: The aging population and the constant advancements in medical technology make this sector robust.

Renewable Energy: As the globe is moving towards sustainability, the investment in solar energy as well as wind power and other green energy sources is rising.

Value Investing

Stocks that are undervalued: Look for firms with solid fundamentals that trade at a lower value than their intrinsic value. This could result in significant gains once the market adjusts.

ESG (Environmental Social, and Governance Investment):

Sustainable Companies. Making investments in companies with ESG practices aligns with personal values. It could even result in an increase in profit because sustainability becomes more prominent among regulators as well as consumers.

REITs (Real Estate Investment Trusts):

Residential and commercial REITs Offers exposure to the real estate markets and does not require the property itself, but with dividends, as well as the potential for capital appreciation.

Options and derivatives

Selling covered calls can help you earn profits from the stocks that are already owned by you.

Buy protective puts: You can safeguard yourself from potential stock price declines by purchasing put options.

Robo Advisors and automated investment:

Robo-Advisors - Platforms such as Betterment and Wealthfront provide automated financial planning using algorithms. They offer portfolios with diversification which are customised to your investment goals and the risk level you are comfortable with.

Other Tips for 2024

Stay Informed. Keep up with market trends, geopolitical and economic events and indicators of the economic situation.

Long-Term Perspective: Focus on the long-term rather than the short-term, to reduce market volatility.

When you are building your portfolio, you should consider diversifying your investment portfolio.

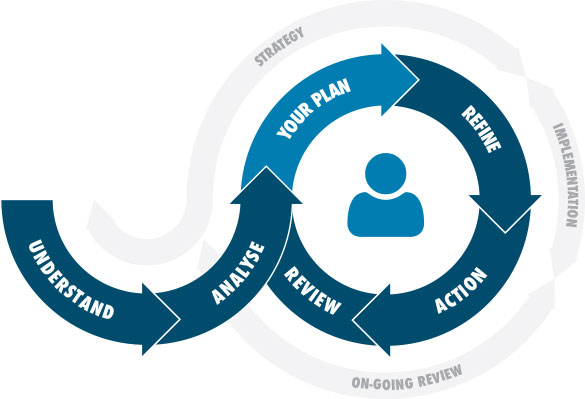

Review and rebalance. Review and regularly balance your portfolio in order to ensure you have the appropriate asset allocations and to maximize the opportunities in the market.

Combining the strategies mentioned above and being flexible to market conditions in 2024, you can optimize stock market investments. Check out the best Crossfi for blog examples.

What Are The 10 Best Methods To Invest In Retirement Accounts In 2024?

For financial stability the investment in retirement accounts is essential. These are the best retirement accounts to put money into in 2024. Employer-sponsored retirement plans should be maximized.

403b, 401k, and 457 Plans - Contribute the the maximum amount, particularly if your employer will match your contributions.

Roth (k): Roth (k) Make a contribution to a Roth-401(k) in the event that it is available, to receive tax-free withdrawals at retirement. This is particularly important if you anticipate being in an income bracket that is higher in the near future.

2. Traditional and Roth IRAs

Traditional IRAs are tax-deductible. The investments can grow tax-deferred. Withdrawals are taxed as income in retirement.

Roth IRA Contributions are made using after-tax dollars, while withdrawals are tax-free in retirement. It is a great option if you anticipate to be in the tax bracket of higher income in the future.

3. Self-Employed Retirement Plan

SEP IRA : Simplified Employee pension IRAs allow for significant contributions, and are perfect for small businesses or self-employed individuals.

Solo 401(k): Ideally suited for sole proprietors. It offers contributions that are high and the option to contribute as an employee and employer.

SIMPLE IRA is designed for small businesses of up to 100 employees. Administration is lower in cost and easier than a 401k.

4. Target-Date Funds

Automated Asset Allocation (AAA): These funds adjust the allocation of assets automatically to be more conservative as you move closer to your retirement date. It's a hands-free method of investing.

5. Index Funds and ETFs

Low-cost and Diversified: Index ETF and index funds offer wide market exposure at the lowest cost, making them perfect for long-term diversification and growth in retirement accounts.

6. Dividend Growth Funds

Steady Income: Investing in funds focusing on firms that have a history of consistently increasing their dividends can ensure an ongoing stream of income in addition to the potential for capital appreciation.

7. Bond Funds

Bond funds can provide stability and an income stream to your portfolio, especially as you get closer to retirement and wish to limit your risk.

8. Real Estate Investment Trusts (REITs)

Diversification and income: REITs provide exposure to real estate markets and provide dividends to help diversify your portfolio as well as generate income.

9. Inflation-Protected Securities

TIPS Treasury Inflation Protected Securities are government securities that index to inflation. They protect your retirement funds from risk of inflation.

10. Alternative Investments

Commodities and Precious Metals. A small amount of commodities, like gold or silver, could be utilized to hedge against the effects of inflation and the uncertainty.

Cryptocurrencies: For the cautious investor, a modest allocation to cryptocurrencies can offer the potential for high growth, but it is accompanied by significant risks and a high degree of volatility.

Additional Tips for 2024

Automated Contributions

Automate your retirement accounts to ensure a consistent investment and to benefit of dollar cost averaging.

Rebalancing and Review:

Check your portfolio on a regular basis and rebalance it in order to keep the ideal asset allocation. Make adjustments for any changes to your tolerance to risk or investment goals.

Take a look at the tax implications

Take into consideration the tax benefits that different retirement accounts can offer and how this fits in to your overall tax plan.

Catch-Up Contributions:

Make catch-up contributions if you age is 50 or over to help increase retirement savings.

Keep informed:

For optimal retirement planning Be aware of any changes to the limits of retirement accounts taxes, investment opportunities.

Get professional advice:

Ask your financial advisor for a personalized retirement strategy which is in line with your financial goals, your timeframe, and your risk tolerance.

By diversifying your investment and staying up-to-date with market trends, aswell as taking advantage of tax-advantaged savings accounts, you'll be able to build solid retirement portfolios by 2024.

What Are The Best 10 Ways To Put Your Money Into Certificates Of Deposit (Cds) 2024?

The idea of investing your savings into Certificates Of Deposit (CDs) could be an easy way to earn money from them. Here are five ways to invest your money in CDs in 2024.

1. Compare Prices to Get the Best Price

Online Banks and Credit Unions: They offer higher rates of interest than traditional banks. This is due to their less expenses.

Comparison Websites - Use sites such as Bankrate, NerdWallet or Bankrate to find CD rates from different institutions.

2. Think about CD Ladders

Ladder strategy: Choose a series CDs that have varying maturities (e.g. 1-year 3-year, 2-year and 3-year CDs) to allow you continuous access to money, and also benefit from the higher rates of interest provided by long-term CDs.

Reinvest: After each CD expires, reinvest the principal and interest into a brand new CD with a longer-term maturity, to keep your ladder and profit from higher interest rates.

3. Consider the length of your contract

Short-Term CDs: Typically vary from 3 months up to 1 year. They provide lower rates of interest, however they provide faster access to your money.

Long-term CDs offer higher interest rates and can range from 2 to five years. Ideal for money that you don't require immediate access to.

4. Find No Penalty CDs

Flexibility: These CDs offer flexibility in the event that interest rates go up or you require funds.

5. Take a look at Step-Up and Bump-Up CDs as well as Step-

Bump Up CDs: These allow you to increase your rate of interest once over the period, if they rise.

Step-Up CDs: Automatically raise the rate of interest at certain intervals during the CD's term.

6. Evaluate Callable CDs

High Rates with Risk: Higher rates of interest are available, however the bank could "call" you at the end of a certain period of duration. The bank can return the principal amount and cease interest payments. This option is ideal for those who do not think that rates of interest will decrease.

7. Be aware of the latest economic developments

Interest Rate Environment Be aware of Federal Reserve actions and economic indicators that could indicate the possibility of changes to rates.

8. Utilize tax-advantaged investment accounts

IRA CDs: Consider holding CDs within an Individual Retirement Account (IRA) in order to gain tax advantages, either by tax-deferred growth (Traditional IRA) or tax-free withdrawals (Roth IRA).

9. Be aware of the penalties and fees.

Early Withdrawal Penalties: You should be aware of the penalties for early withdrawal that can differ dramatically between different institutions. Make sure you are familiar with these terms prior investing.

Maintenance Fees. Confirm whether there are any fees per month which could reduce your earnings.

10. Diversify CD Investments

Mix Terms and Types : To balance your access to rates and funds Diversify your CD investment between different terms and type (e.g. traditional No penalty, bump-up).

Other Tips for 2024

Automated Renewal Policy:

Find out if the CD you have will renew automatically at expiration, and if so and under what conditions. If you decide to not renew it will permit you to look at other options for the time of maturity.

FDIC Insurance:

Assure that your CDs come from institutions insured by FDIC (or NCUA in the case of credit unions) They will also guarantee your deposits for up to $250,000 per depositor and for each institution.

Set up alerts

Utilize calendar or bank alerts to monitor CD maturities to stay clear of automatic renewals, which could result in lower rates. Also manage reinvestment and Reinvestment plans.

Stay Disciplined:

Beware of the temptation to withdraw funds too soon. There will be penalties unless it is absolutely necessary. The longer you leave the money in the CD and the longer you keep it, the more you benefit of compound interest.

When you choose your CDs with care and following these methods it is possible to increase the value of your investment while preserving the stability and security CDs will offer in 2024.

Other Tips for 2024

Take your time and do your due diligence

Market Research: Determine the size of the market as well as the potential of it. Also, identify the level of competition.

Management Team: Assess the team's expertise, track record and capabilities.

Financial Projections: Examine the financial health of the business with its projections, as well as the business plan.

Diversify Your Portfolio:

Spread your investments across various sectors, startups and phases of development to minimize risks and boost potential returns.

Be aware of the dangers:

Be mindful of the risks involved in investing in private equity or startups. There is a chance that your investment will be completely lost. This asset class should not be a large part of your portfolio.

Leverage and Networking expertise:

Relationships with experienced investors, specialists in the field, as well as venture capitalists can help you access high-quality investment opportunities.

Keep up-to-date on the latest trends

Keep abreast of industry trends as well as emerging technologies and economic developments that may influence the startup and private equity landscape.

Compliance with the law and regulations:

Check that all investments comply with regulations and legal standards. Get advice from financial and legal experts to understand the complexities of private investments.

Exit Strategy:

You must have a plan for exiting your investments.

These strategies can assist you to balance your risk against the potential reward from investing in private equity or startups in 2024.