Free Facts On Deciding On Britannia Gold Price

Wiki Article

What Factors Should I Take Into Consideration When Buying Gold Coins/Bullion From Czech Republic?

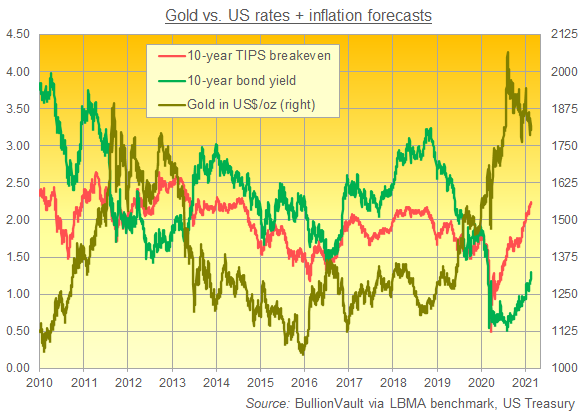

Tax Implications: Be aware of tax implications related to buying and selling gold in the Czech Republic. There could be different tax laws when you invest in gold. This could affect the returns you earn. Market Conditions: Monitor the market and watch for changes in the gold price. This will help you to make more informed choices regarding the timeframe for your investment in gold.

Verify the authenticity: check the certification of any gold coins or bullion before purchasing.

Make clear your investment goals. Consider whether gold is being purchased to preserve the wealth of your portfolio, diversify it, or safeguard against inflation or economic uncertainties.

Consultation and research- seek advice from experts or financial advisors in precious metals investments. Make smart investments by conducting exhaustive research about the gold market.

When you are considering your investment options, such as precious metals, be sure to conduct a thorough study and be aware of your financial goals and tolerance for risk. See the recommended buy Prague gold price for site tips including sell gold coins, gold ira best, barrick stocks, 50 dollar gold piece, gold 1 dollar coin, jm bullion gold price, gold coin with angel on both sides, sd bullion gold, gold bullion coins, small gold coins and more.

How Can I Be Sure That The Quality Gold Coins And Bullion That I Purchase Are Of Good Quality?

Verifying the legitimacy of gold bullion or coins from the Czech Republic requires several steps.-

Certification and Hallmarks- Look for hallmarks or marks on gold items. These hallmarks, which are usually issued by trustworthy institutions or assaying offices, indicate the authenticity, weight and purity of the gold. Verify the purity of the gold by looking for marks that indicate the quality or the karatage. Also, 24 karat gold is pure, while lower karatages are evidence of different levels of alloying.

Reputable sellers- Purchase gold only from dealers that are reliable, reputable, and authorized. They typically offer authentic certificates of authenticity and receipts which list the gold specifications.

Ask for Documentation - Request certificates of authenticity or assay certificates that accompany the purchase of gold. These documents should include details about the gold's purity weight, weight, manufacturer and the hallmark.

Independent Verification: Request an independent appraisal or verification by an expert from a third party. They can verify the authenticity of the gold and give an objective assessment of its quality.

The process of confirming gold bullion or coins is a procedure which requires diligence and relying on reputable sources. You should also acquire the required documentation to prove you are purchasing high-quality and authentic gold. Read the top click this link about buy Bohemia coins for site recommendations including kruger rand, gold 1 dollar coin, 1972 gold dollar, 2000 sacagawea dollar, american eagle gold coin price, bullion trading, jm bullion gold price, agi stocks, coin 1, gold and coin near me and more.

What Is A Small Mark-Up On The Stock Market And A Tiny Price Spread Of Gold?

When it comes to gold trading low mark-ups and low price spread are the costs associated with buying or selling gold, based on the market value. These terms define the additional cost that you could pay (markup) and the difference between the prices you pay for buying and selling prices. Low mark-up: This is a small amount of money that the dealer adds to the gold market price. A low markup indicates that the price you pay for gold is either close to or just a little more than, the current market price.

Low Price spread- The price spread is the difference between the selling and buying prices (ask and bid) for gold. A spread that is low indicates that the difference between the two prices is smaller that is, there's a smaller gap between the price of gold and the price of selling it.

How Much Does The Markup And Price Difference Between Gold Dealers Vary?

The price spreads and mark-ups for gold may differ significantly between dealers based on various factors, including their operations, models of business as well as their reputation and pricing strategies. These are some general considerations concerning the variances. Dealer Reputation & Service Quality- Established, reputable dealers may charge higher marks-ups based on their perceived quality, reliability and customer service. On the other hand, less established or newer dealers may offer lower mark-ups to attract customers.

Business model and overhead costDealers who offer premium services or physical storefronts might have more expensive costs to pay for. Therefore, they will increase their prices to make up for the cost. Online sellers or those who have lower operational costs could provide a more competitive price.

Pricing Transparency- Dealers with transparent pricing structures tend to have lower mark-ups as well as tighter spreads in order to draw customers looking for clear and fair pricing.

In light of these issues, it is imperative to ensure that gold buyers conduct their research, and compare prices of different dealers and take into account other factors in addition to markups and spreads. These include reputation, reliability, service and customer satisfaction. A quick search and comparison of quotes from a variety of sources can help identify competitive prices for gold purchases. See the best buy gold price Prague examples for site tips including gold stocks price, old silver dollars, 50 pesos gold coin, best gold ira, gold ira companies, american gold eagle 1 oz, gold and silver dealers, 1 oz gold coin price today, golden dime, gold investment firms and more.